tax brackets australia

Income taxable at 19. 5 hours agoRising rates soaring costs and a Tax Office crackdown on unpaid debts are leading to a surge in failures among uneconomic zombie firms as challenging conditions cause.

|

| Tax Rates In Us And Australia Download Table |

National income tax rates.

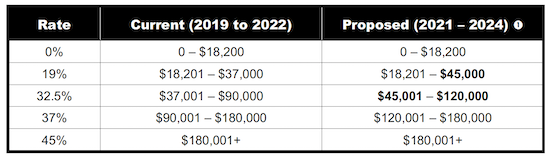

. The tax bracket changes announced in Budget 2020 reflected in the table above were. 37000 18201 18799. Lets break it down Total Income. The modified rates lifted the 325 rate ceiling from 87000 to 90000.

The tax-free threshold is 18200 so if you earn anything below that you wont be required to pay income tax. The maximum tax offset of 70000 applies if your taxable income is 3700000 or less. Many believe that when you earn enough money to enter a new tax bracket you will pay a higher rate of tax on all your income. 90000 37001 52999.

But this is where people get confused. 325 Taxable income band AUD. If your taxable income is less than 6666700 you will get the low income tax offset. Income taxable at 325.

90001 to 180000 National income tax rates. The individual income tax rate in Australia is progressive and ranges from 0 to 45 depending on your income for residents while it ranges from 325 to 45 for non-residents. The legislation is here. The maximum tax offset of 70000 applies if your taxable income is 3700000 or less.

But because that one dollar puts you into a higher tax bracket your income actually spans three tax brackets. 19 Taxable income band AUD. If your taxable income is less than 6666700 you will get the low income tax offset. Tax owed at this tax bracket.

Reflected in the above table are tax rate changes from the 2018 Budget for the 2 years from 1 July 2022 to 30 June 2024 which include an expansion of the 19 rate initially to. On the governments measure the amendments are estimated to be about one-hundredth of the 16bn in additional interest rate costs that Queensland landlords have. They determine the rate of tax that each Australian taxpayer pays based on their annual. Tax owed at this tax bracket.

You can find our most popular tax rates and codes listed here or refine your search options below. Moreover if you earn above 90001 you will have to pay an. 37001 to 90000 National income tax rates. State governments have not imposed income taxes since World.

Otherwise the tax bracket you fall into will depend on how much. On top of this sum you have to pay a 2 Medicare Levy. Make sure you click the apply filter or search button after entering your. Income tax in Australia is imposed by the federal government on the taxable income of individuals and corporations.

Tax brackets in Australia are set by the Federal Government and the Australian Tax Office ATO. Your tax bracket consists of your total earnings after tax deductions. The 19 rate ceiling lifted from 37000 to 45000 the 325 tax bracket ceiling lifted. Tax rates and codes.

|

| Tax Rates In Us And Australia Download Table |

|

| 2020 21 Federal Budget Northern Business Consultants |

|

| Save Thousands Of Dollars In Taxes With A Student Visa Go Study Australia |

|

| 2020 21 Individual And Business Tax Rate Changes Walsh Accountants Gold Coast Accountants |

|

| 3 Individuals Treasury Gov Au |

Posting Komentar untuk "tax brackets australia"